Advertising feature: Retirement is meant to be a time of relaxation and enjoyment, when you can look forward to simpler, less strenuous years ahead.

At any point in your working life, you may wish to find out how much pension savings you have and start managing them. For those who have spent their working years at different firms, it is not surprising if you have multiple pension ‘pots’ or plans that have been built up, based on the specific provider your employer(s) used at the time you were working. You may also have personal pensions if you’ve spent time self-employed.

However, handling multiple pension plans can create unneeded complexity and stress which retirees don’t want the hassle of. Furthermore, providing for your family’s future doesn’t need the complications associated with multiple pensions and funds tied up in different accounts.

This is why it pays off, to do some essential pension preparation before you retire, where your finances are kept in good working order, easily accessible and not causing headaches or stress unnecessarily. It can be tremendously rewarding, to consolidate all your pension amounts for straightforward access during your retirement.

Consider Pension Consolidation

Consolidating your pensions into one simplified portfolio can provide greater ease and transparency in your later years. Ultimately, you want to ensure that you’re not missing out on any money owed to you. There was an estimated £9.7 billion of unclaimed defined contributions in the UK alone, as highlighted in December 2022 by accredited Sussex financial advisors Reeves Financial.

Keeping all your cumulative pension amounts together in one accessible place is far easier than keeping separate pots. Even if you don’t plan to ‘fully’ retire, it’s still preferable to get these amounts organised ahead of time to save you worrying about it later.

This guide will walk you through the pension consolidation process and help you determine if streamlining your plans is the right move for your situation.

The Pros of Pension Consolidation

Combining multiple pension pots into one account offers several potential benefits:

Simplicity - Dealing with just one pension provider and account makes it easier to manage your funds and understand your investments as you enter retirement. No more struggling to keep track of various plans, contact details, statements, or account numbers.

Clearer overview - With all your retirement savings in one place, you can see your total balance more easily, along with how your investments are allocated. This helps in planning withdrawals and ensuring your assets last.

Potential cost savings - Maintaining multiple pension accounts can result in higher fees versus a consolidated plan with lower charges. You may also qualify for reduced fee tiers by reaching investment minimums.

Easier to pass on - Having just one pension makes it simpler for your loved ones to inherit your remaining retirement assets upon your passing.

More investment options - Larger consolidated pension pots may provide access to a wider range of investment funds and assets otherwise unavailable.

Better performance monitoring - Tracking the growth and returns of a consolidated pension is simpler with all holdings in a single account.

Factors to Consider Before Consolidating

While pension consolidation offers many advantages, it also involves some considerations that you should bear in mind. These include:

Transfer fees - Moving pensions can incur some administration fees. Check these costs before making the switch and see if it’s worth it.

Risk of volatility - Markets may fluctuate while funds are being transferred between providers. You may wish to hold off on a change until the market is stable.

Exit penalties - Some pensions charge early exit fees. Familiarise yourself with these before transferring out any of your funds.

Loss of benefits - Certain pensions have unique benefits you may lose when consolidating, like guaranteed annuity rates.

Scams - Be wary of shady providers encouraging transfers. Only use reputable, FCA-regulated firms.

Tax implications - Consolidating pensions of different tax statuses could impact your obligations. This is why it’s prudent to seek professional advice before doing so.

Long transfer times - Moving pensions can take several weeks. Factor this time delay into any consolidation plans.

Reinvesting assets - If your various pensions have different investment strategies, you'll need to reallocate them when combining them. This takes additional planning and preparation.

Ensuring Smooth Pension Consolidation

Follow the steps outlined below for a successful pension consolidation process.

Clearly define your pension goals and objectives, like lowering fees or simplifying management. This gives focus to the process and means you’re less likely to deviate going forward.

Review plan documents and agreements for any exit clauses, fees, or conditions. Understand the transfer parameters you’re facing and how easy - and affordable - the process will be.

Shop around different pension providers to find the best-consolidated account for your needs regarding fees, investment options, benefits and services.

Consult with an impartial, qualified financial advisor to determine if consolidating makes sense for your personal situation and the most appropriate approach.

Start the consolidation process well in advance of needing your pension funds. Transfers can take weeks, months, or even longer for some highly complicated portfolios.

Keep detailed records about each pension including account numbers, provider contact details and investment information. Being aware of all relevant factors will help smooth the transfer.

Check and validate your consolidated account regularly to ensure your investment strategy still aligns with your retirement plan.

Who Can Benefit Most from Pension Consolidation?

Not everybody will benefit from consolidating their pensions. It will ultimately depend on your account’s complexity and whether your employment circumstances during your working life will make the process worth it.

Individuals in certain situations often stand to gain the most from consolidating their pensions.

For starters, frequent job changers who have built up multiple workplace pensions may benefit by combining them for complete simplicity and visibility. Self-employed professionals may have set up individual pension pots over their working years which may be best served to be merged together.

Individuals who have sizable retirement savings can also benefit from the expanded investment opportunities and benefits of a larger, consolidated pension pot. This type of clean, simple slate is also beneficial for people who have inherited various pension amounts through past company acquisitions, mergers, or takeovers.

As for British nationals who have emigrated, worked and later retired abroad, they may have fragmented pension accounts. Bringing them together enables easier administration.

Take Control with Pension Consolidation

While consolidating your pensions takes time, effort and resources, it’s clear to see how simplifying them can make your life easier during retirement. Take some time to understand your various options and consult with a reputable financial advisor to get the expert, tailored advice that best suits you and your retirement plans.

Home Style: Seeing the Light

Home Style: Seeing the Light

Step out for St Catherine’s Hospice

Step out for St Catherine’s Hospice

If You Ask Me... This is Beyoncé Country

If You Ask Me... This is Beyoncé Country

Artelium Wine – Crafted in Sussex

Artelium Wine – Crafted in Sussex

Homes Extra: Expanding Space

Homes Extra: Expanding Space

Kids Zone: Mosaic Art

Kids Zone: Mosaic Art

Be Well, Move Happy: Gardening & Connecting with Nature

Be Well, Move Happy: Gardening & Connecting with Nature

Homes for Ukraine: Opening Your Home and Your Heart

Homes for Ukraine: Opening Your Home and Your Heart

Charity: Age Concern Hassocks

Charity: Age Concern Hassocks

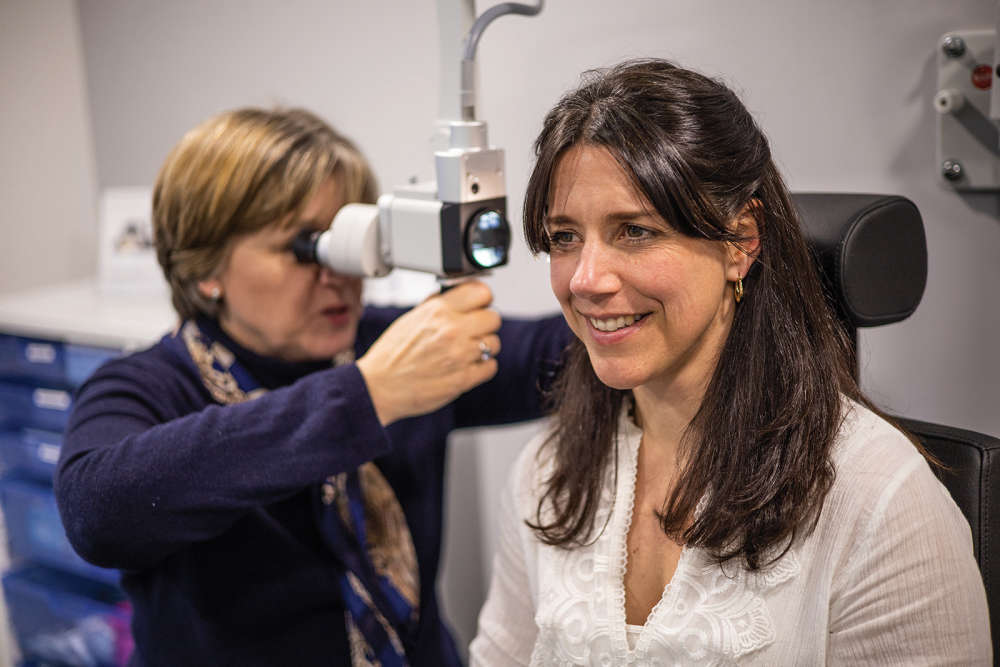

Another New Clinic For Sussex Audiology

Another New Clinic For Sussex Audiology

The Joy of the Repair Café

The Joy of the Repair Café

Wills & Wakes

Wills & Wakes

Lighten the Technology Overload

Lighten the Technology Overload

An Unlikely Retirement

An Unlikely Retirement

COMPETITION: Win A Two-Night Stay At The View Hotel With Afternoon Tea For Two

COMPETITION: Win A Two-Night Stay At The View Hotel With Afternoon Tea For Two

What to Watch in April 2024

What to Watch in April 2024

Bucket List Travel Experiences

Bucket List Travel Experiences

Homes Extra: An Easter Home

Homes Extra: An Easter Home

NEW COMPETITION: Win A Luxury Hamper For National Pet Day

NEW COMPETITION: Win A Luxury Hamper For National Pet Day

Home Style: Time to Heal

Home Style: Time to Heal